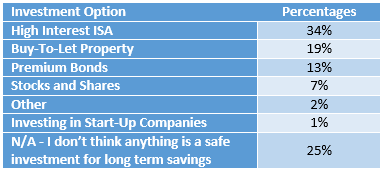

While both Buy-To-Let property and high interest ISAs (34%) were popular with respondents, worryingly, 1 in 4 people lacked confidence in the safety of any investment option and said nothing in particular is a safe bet for long term savings.

Question Asked: Which one, if any, of the following do you think would be the "safest investment option" for your long term savings?

While the heady, easy money days of Buy-To-Let may be behind us, the property investment model is still viewed as one of the safest long term investment options – with 19% of Brits favouring Buy-To-Let over ISAs, stocks and shares, premium bonds and investing in start-up companies, for their long-term savings.

However, it was interesting to note that a sizable 25% of people surveyed lacked faith in the safety of any long term investment option, and instead believe that nothing in particular is a safe bet for long-term savings.

Older generations were less inclined to trust Buy-To-Let safety in the long term, with just 15% of those aged 55 and over selecting this option, compared to 25% of 35-44 year olds. The most popular safe bet investment option for 55 and overs were high interest ISAs, with more than 1 in 3 (36%) choosing this option.

Buy To Let Most Popular in London, but Investment Confidence Low Elsewhere

There was significant regional variation across the UK when it came to the perceived safety of BTL investment for long term savings. BTL was most popular with people in London, with 1 in 4 (26%) respondents viewing it as the safest investment option – compared to just 11% of people in the North East (excluding those who said “don’t know”).

In fact, people in the North East were far less trusting of investment safety in general, with more than 1 in 3 people (35%) in the region saying there is no such thing as a safe investment for long-term savings – compared to around half that amount (17%) saying the same in London.

Nick Marr, Co-founder of TheHouseShop.com, commented: “It was certainly worrying to see such low confidence in the safety of long-term investments, especially in some areas like the North East where more than a third of people said there was no such thing as a “safe bet” for their long-term savings."

Londoners seemed more optimistic on the ability of stocks and shares to maintain long term savings, with 12% selecting this option compared to the nationwide average of just 7%. When it came to the gender divide, men were twice as likely to view stocks and shares as the safest investment (4% women vs 9% men), while women were more likely to doubt the safety of their long term savings with any investment option - with 29% women vs 21% men saying that nothing in particular is a safe investment for long term savings.

Nick had this to say: “It was interesting to see that despite the recent cuts to Buy-To-Let tax relief, increased Stamp Duty on second home purchases and tighter rules for BTL lending, property investment still holds enduring appeal for Brits looking to secure their long-term savings."

The fact that 1 in 5 Brits still view Buy-To-Let as a safer investment option than stocks and shares, premium bonds, investing in start-up companies and even ISAs, demonstrates confidence in the strength of the UK property market and its ability to maintain investments in the long run.

However it was also quite worrying to see that so many people belive they do not have a safe investment option available to them and feel they cannot guarantee the safety of their long-term savings in the current economic market. Perhaps these people are more pessimistic about the fortunes of the housing market over the coming years, or fear a potential interest rates rise that could see Buy To Let mortgage repayments sky-rocket."